Navigation: Finances → Pro Forma Invoices

Pro Forma Invoices provides information about inflow received from contracts before the services are provided. Mostly Pro Forma Invoices are used with FIX or FIX/TM type contracts.

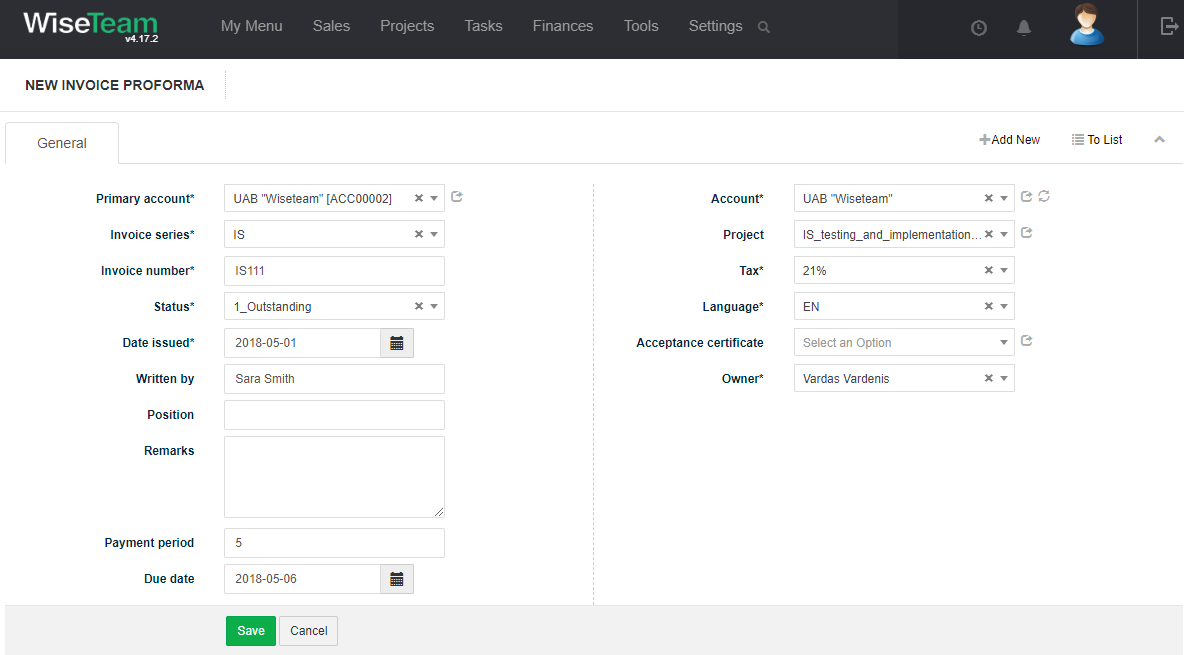

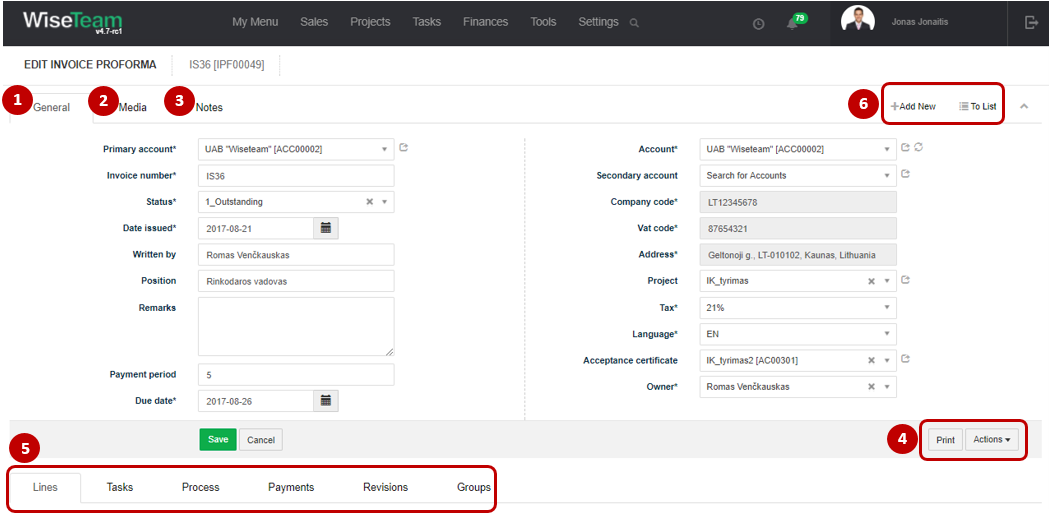

Review Pro Forma Invoice form

1. General information about Pro Forma Invoice is provided in tab General. You have to fill in this information when creating new Pro Forma Invoice.

2. In tab Media it is possible to attach files. Click Select Files or do Drag & Drop.

3. In tab Notes it is possible to leave notes. Click Add note to create new note.

4. Actions that can be taken with Invoice:

- Print: generates filled PDF version of Pro Forma Invoice that is ready to be printed.

- Update account: updates Pro Forma Invoice account with final related data (company code, Vat code, address).

5. Available Info Tabs:

- Lines: Invoice parts (lines) that were established in the contract or Acceptance Certificate. Click

to create new line and provide the required information.

to create new line and provide the required information. - Tasks: list of Tasks related to Invoice. Click

to add new Task or

to add new Task or  and select Process to generate Tasks from a template.

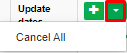

and select Process to generate Tasks from a template. - Process: it is possible to create new Process from template. If multiple processes are running, you can cancel active processes with Cancel all at the same time,

.

. - Triggers: allows seeing and adding Task triggers related to this Task.

- Payments: information about planned and received payments regarding provided services for clients. Red colored lines means that the payment is not yet received. Click

to create new Payment and provide information.

to create new Payment and provide information. - Revisions: history of actions taken with the Pro Forma Invoice.

- Groups: allows grouping Pro Forma Invoice according to types determined (list is taken from Settings → Groups).

6. Available navigation buttons:

- Add new: is used to create new Pro Forma Invoice.

- To list: is used to go to the list of Pro Forma Invoices.

Create new Pro Forma Invoice

To create new Pro Forma Invoice follow these steps:

1. Go to Finances → Pro Forma Invoices and click ![]() .

.

2. Fill in fields in tab General:

- Invoice Number: automatically generated number (rule is defines in Settings → Settings → Invoice), if required number can be changed manually.

- Invoice series: automatically generated series (rule is defines Settings → Settings → Invoice Series).

- Status: indicates the progress of the Pro Forma Invoice (list is taken from Settings → Dictionary → Invoices → Status). Status is updated according to Invoice Amounts.

- Date Issued: date when the Pro Forma Invoice was issued. Automatically generates the current date.

- Written by: indicate information about person who had created the Pro Forma Invoice. By default it is the user who is logged in, if required can be manually changed.

- Written by position: indicate information about person’s position that had created the Pro Forma Invoice. By default it is the position of the user who is logged in, if required can be manually changed.

- Remarks: notes that are related to the Pro Forma Invoice.

- Payment period: payment period filled automatically according to payment period defined in a related Project’s form. If payment period is not defined in Project’s forms, default payment period defined in Settings will be filled.

- Due date: payment due date. Calculated automatically according to Pro Forma Invoice creation date and payment period.

- Account: indicates the account that the Pro Forma Invoices is being written for.

- Project: should be filled if Pro Forma Invoice is related with Project of previous stated Account.

- Tax value: tax rate for the Pro Forma Invoice.

- Language: indicates language in which PDF version of Pro Forma Invoice that is ready to be printed have to be generated. Language is set according to Account language when Account is selected.

- Acceptance Certificate: reference to the Acceptance Certificate that the Pro Forma Invoice has been generated from or is related to.

- Owner: user that created Pro Forma Invoice record.

3. Click Save.

It is also possible to generate Pro Forma Invoice from related Acceptance certificate.

Add Pro Forma Invoice line

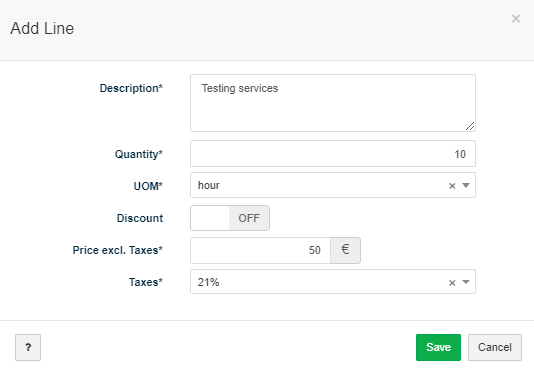

To add Invoice line follow these steps:

1. In tab Lines click ![]() .

.

2. Fill in Line information:

- Description: description of the provided services, products.

- Quantity: quantity of units of measurements.

- UOM: unit of measurement.

- Discount: active discount allows to add negative Price excl. Taxes.

- Price excl. Taxes: price excluding taxes.

- Taxes: tax used for invoice proforma line.

3. Click Save.

In case Pro Forma Invoice is generated from related Acceptance certificate Pro Forma Invoice lines will be automatically copied from the Acceptance certificate.

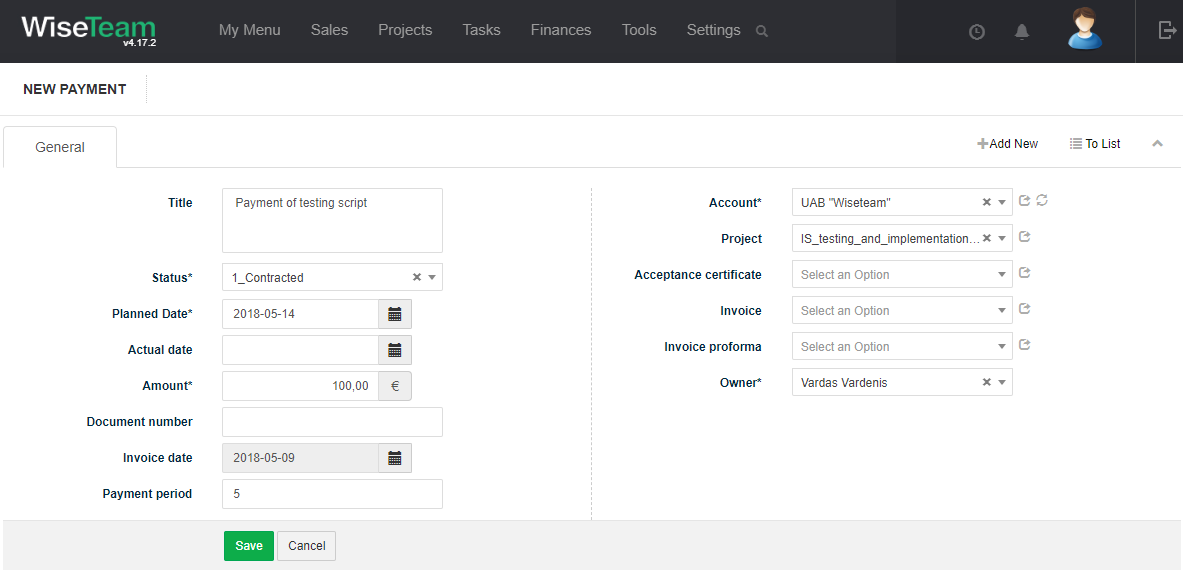

Add new Payment

There is a possibility to create new related Payment or assign existent Payment.

To add new Payment follow these steps:

1. In tab Payments click ![]() .

.

2. Fill in Payment information:

- Title: indicates what particular payment is about.

- Status: indicates what is the progress of a payment (list is taken from Settings → Dictionary → Payments → Status).

- Planned date: indicates planned date of the payment.

- Actual date: indicates date when the payment was received.

- Amount: indicates full amount of payment including taxes

- Document number: indicates unique document number.

- Account: Payment account (list is taken from Sales → Accounts), when creating Payment from Invoice form filled automatically.

- Project: indicates related Contract to particular Payment. (list is taken from Contracts → Contracts).

- Acceptance certificate: indicates related Acceptance Certificate to particular Payment (list is taken from Finances → Acceptance Certificates), when creating Payment from Acceptance certificate form filled automatically.

- Invoice: indicates related Invoice to particular Payment ( list is taken from Finances → Invoices).

- Invoice Proforma: indicates related Pro Forma Invoice to particular Payment (list is taken from Finances → Pro Forma Invoices), when creating Payment from Pro Forma Invoice form filled automatically.

- Owner: user that created payment record.

3. Click Save.

To assign existent Payment follow these steps:

1. In tab Payments click ![]() to Assign.

to Assign.

2. Select related Payment from the list.

3. Click Save.

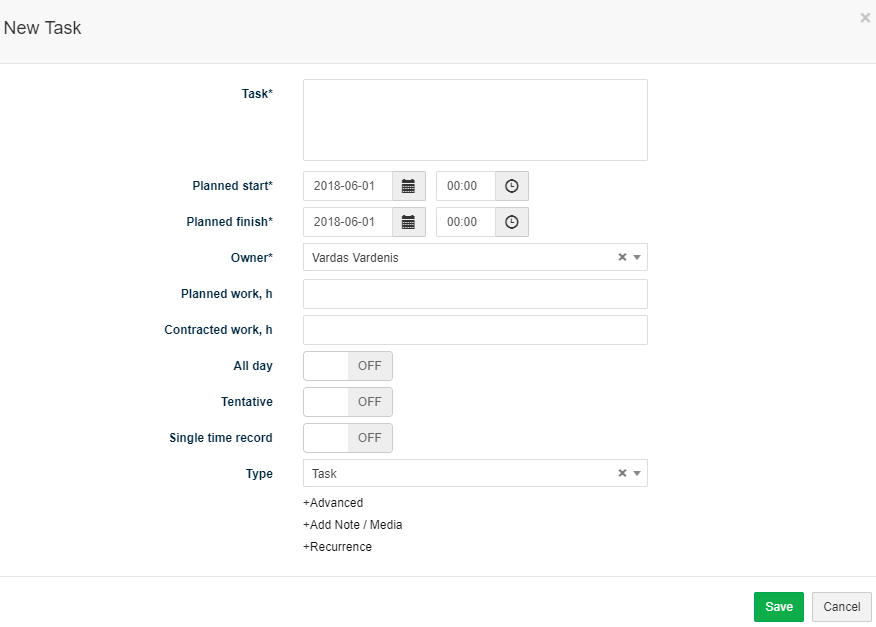

Create Task related to Pro Forma Invoice

It is possible to create Tasks related to Pro Forma Invoice in several locations of the system: Kanban window, Tasks list window, Pro Forma Invoice form, Pro Forma Invoices list window.

To create new Task related to Pro Forma Invoice in the Invoice form follow these steps:

1. In tab Tasks click ![]() .

.

2. Fill in Task’s information and click Save.

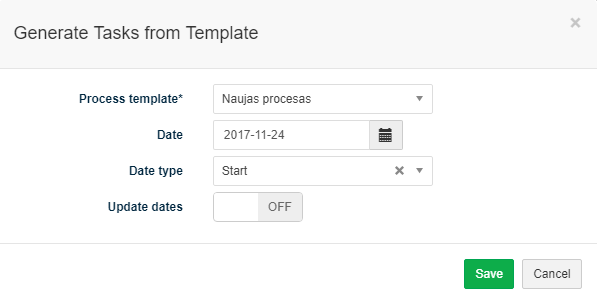

Generate a set of Tasks related to Pro Forma Invoice (initiate Process)

It is possible to generate a set of Tasks related to Pro Forma Invoice from a template (initiate a predefined process). To generate a set of Tasks related to Pro Forma Invoice follow these steps:

- In tab Tasks click

and select Process or in tab Process click

and select Process or in tab Process click  .

. - Select process template from the drop-down menu (list is taken from Settings → Processes).

- Define date when process should start / finish.

- Define date type: Start – First Task of the process will start on the indicated date, Finish – dates of the process Tasks will be defined so that the process would end on the indicated date. Important: there is a possibility to define process finish date only if process does not have decision tasks.

- Active Update dates option automatically updates tasks dates when changes in process task planned dates are made.

- Click Save.

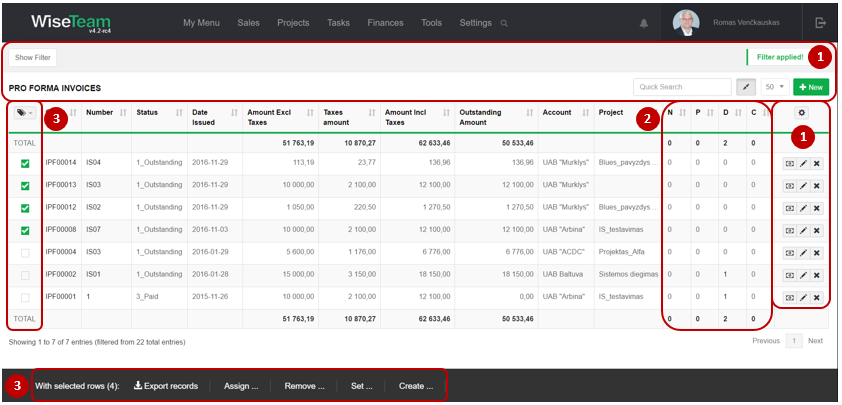

Perform actions in the list of Pro Forma Invoices

1. As in all lists, you can work with Pro Forma Invoices by using standard functionality buttons: filter Pro Forma Invoices, add new Pro Forma Invoice, change table properties, search Pro Forma Invoices, narrow or extend information viewable in table cells, edit or add additional information to the Pro Forma Invoice, delete Pro Forma Invoice from the list.

2. It is possible to see how many related Not Started, In Progress, Waiting, Done or Cancelled tasks Pro Forma Invoice has.

3. It is possible to perform actions with Pro Forma Invoices in the list without opening the entries. After selecting single or multiple Pro Forma Invoices by marking lines ![]() or selecting all Pro Forma Invoices by clicking

or selecting all Pro Forma Invoices by clicking ![]() button available actions are:

button available actions are:

- Export records: is used to export selected Pro Forma Invoices to MS Excel file.

- Set Status: is used to set status of selected Pro Forma Invoices.

- Set Owner: is used to set owner of selected Pro Forma Invoices.

- Set Groups: is used to set up a group for selected Pro Forma Invoices.

- Create Task: is used to create new Task related to selected Pro Forma Invoices. In case several Pro Forma Invoices are selected several Tasks will be created.